FY 2020 IFRS RESULTS

EuroChem posts record earnings despite pandemic, underpinning new growth ambitions

Highlights:

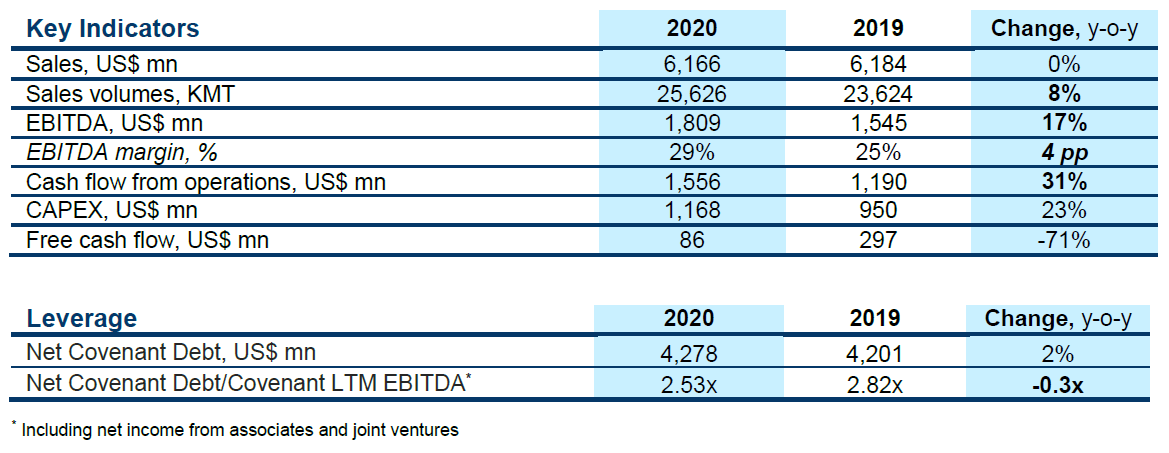

- EBITDA up 17% to record US$1.8 bn; EBITDA margin up 4 percentage points to 29%

- Sales flat in 2020 year-on-year, with fertilizer volumes 12% higher

- Cash flow from operations 31% up

- Potash sales doubled year-on-year reaching 2 MMT, accounting for 12% of total fertilizer revenues

- Net leverage ratio decrease to 2.53x

Zug, Switzerland, February 9, 2021 – EuroChem Group AG (hereinafter “EuroChem” or the “Group”), a leading global fertilizer company, today reported consolidated full-year 2020 sales of US$6.2 billion and sales volumes of 25.6 million metric tonnes (MMT), with company-record EBITDA of US$1.8 billion.

The unprecedented EBITDA figure represents a 17% year-on-year jump and comes despite the turbulence of the global coronavirus pandemic and lower average prices for fertilizers during 2020. The key contributors were an increase in output, strong prices for iron ore concentrate, EuroChem’s key by-product, and favorable currency exchange rates. The EBITDA margin appreciated by 4 percentage points and reached 29% in 2020, driven chiefly by an increase in potash production from the Group’s Usolskiy Potash Plant.

Through 2020 the Group generated cash flow from operating activities of U$1.6 billion, 31% above the 2019 level, supported by a favorable change in net working capital. Free cash flow amounted to US$86 million, reflecting the Group’s ability to fund new growth projects in-house. The Group increased capital expenditure by 23% to US$1.2 billion in 2020 on the decision to proceed with EuroChem Northwest 2 project, a new facility for the annual production of 1.1 MMT of ammonia and 1.4 MMT of urea. Maintenance capex amounted to 28% of total, with the rest allocated to key expansion projects: ECNW2, Usolskiy and VolgaKaliy potash plants.

The US$1.8 billion EBITDA figure beats the previous high of US$1.7 billion posted in 2011.

“Our ability to post record EBITDA and decrease our leverage ratio in the conditions of the most challenging global pandemic in modern times speaks to our resilience, flexibility and governance,” said EuroChem Group CEO Vladimir Rashevskiy, “With the help of meticulous planning, accurate market intelligence and smart risk mitigation, we have avoided any significant disruption to the business and kept our customers supplied with the nutrients they need to help feed the world,” he added. “These results underpin our growth ambition to reach the top of the fertilizer industry by maximizing our vertically integrated business model and forging ahead with highly promising expansion projects such as EuroChem Northwest 2.”

Market overview

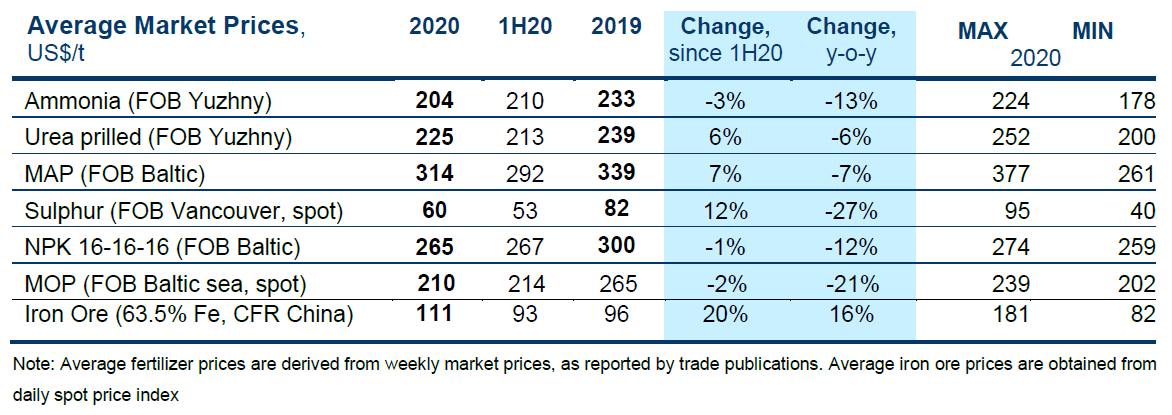

Price performance was mixed across different fertilizers segments and iron ore, although a pronounced recovery trajectory emerged at the end of the year. The market is revealing signs of further strengthening in the coming months due to supply and demand balancing out and the continued favorable environment for fertilizers as a critical component in underpinning food supply during the COVID-19 pandemic.

A gradual recovery in ammonia prices in the second half of the year was attributable to production issues in Indonesia, reduced output in Trinidad, a rise in US industrial demand together with short supply in the West and ongoing buyer unease.

Urea’s upward performance in the second half of 2020 was driven by strong demand in India and China, and awakening buying interest in Europe, as well as seasonal pick-ups across the US and Brazil. Factors such as a strengthening grain-to-fertilizer ratio, higher energy costs, and reduced production and export from China, led to

a $30/t climb in granular urea prices in December over January levels.

Phosphate prices have increased strongly in all markets from the beginning of Q3 (up 15-25% globally and by 40% in the United States) as a global deficit emerged due to strong Indian and Brazilian import demand, constrained Chinese exports and production issues in Tunisia, Egypt and South Africa. The preliminary application of prohibitively high countervailing duties on Russian and Moroccan phosphates from November continued to cause shifts in global trade patterns and has reinforced the spread between US and global phosphate prices.

The potash market returned to a more balanced position at the end of the year and supported a stable pricing environment across major markets in Europe, Brazil and Southeast Asia. At the same time short-term supply constraints and very strong domestic US demand contributed to a sharp recovery in NOLA prices from $190/t at the beginning of the fourth quarter to around $240/t by the end of December.

Iron ore prices fluctuated during the second half of the year, but remained generally strong relative to 2019. Restocking demand in China before the Chinese New Year and higher demand from flat steel producers combined with supply concerns from Brazil and Australia pushed prices to $165/t CFR China for 62% Fe in December, $75/t above January levels.

Sales

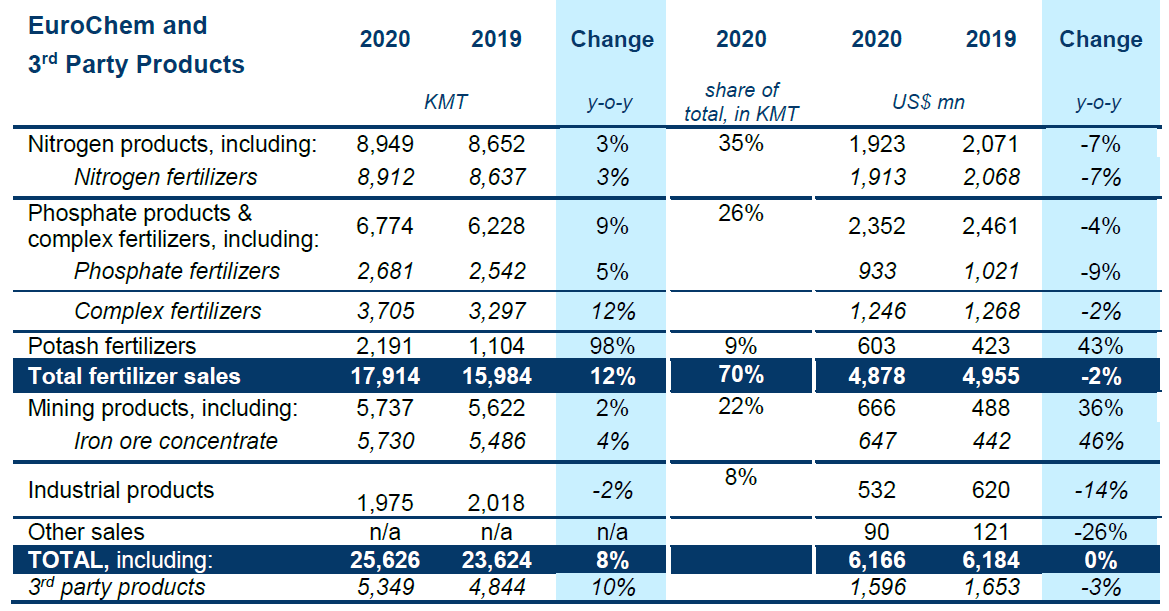

In 2020 the Group achieved total sales volumes of 25.6 million metric tonnes (MMT), with fertilizer sales accounting for 70%. Fertilizer sales volumes were 12% up on the back of production increases at the Usolskiy Potash Project and the EuroChem Northwest ammonia facility, which was operating at full capacity in 2020, as well as a rise in third-party product sales. Total sales remained flat in 2020 mainly due to a softer pricing environment in fertilizers, however mining segment sales in monetary terms improved by 36% on high iron ore concentrate prices, despite just a 2% increase in sales volumes.

Sales volumes of nitrogen, accounting for 35% of total sales volumes, rose by 3%, with CAN and UAN the leading product performers. A doubling of ammonia sales volumes, representing a 6% share in the nitrogen segment, contributed to the performance of nitrogen fertilizers as well.

Phosphates and complex fertilizers sales increased by 9% in volume terms, with NPKs and MAP the major drivers. DAP sales volumes decreased by 16% as the Group prioritized MAP production due to more favorable market conditions. EuroChem changed the trade flows of its phosphate fertilizers mostly in favor of the Latin American market after the imposition of preliminary duties on phosphate fertilizers by the US Department of Commerce in November 2020.

Potash sales doubled in 2020 and reached a new high of 2.2 MMT. The potash segment is becoming firmly embedded in EuroChem’s top line with the gradual ramp-up of production from its potash development projects.

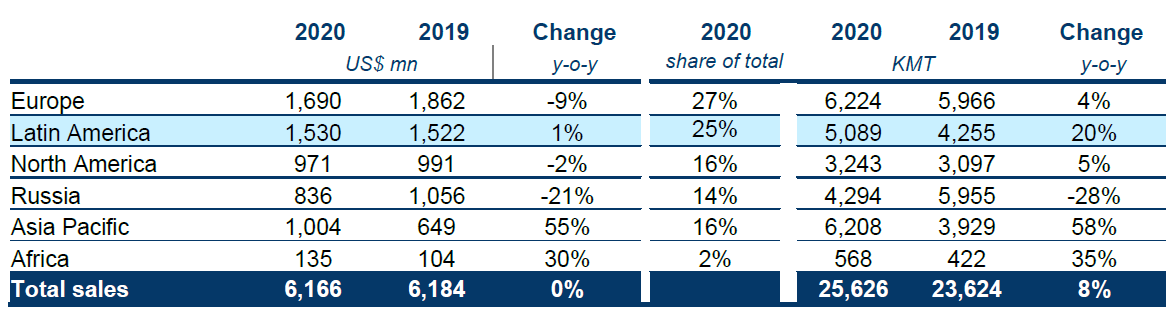

Geography of Sales

EuroChem’s sales historically are well diversified across the main agricultural regions and the Group continues to increase its market share in key territories. Sales to Latin America rose to 5.1 MMT in 2020, up 20% from 2019. The region accounted for 25% of total sales, with Brazil constituting the major driver at 22%. Latin America’s importance to EuroChem was underlined by the full consolidation of its main distributor in Brazil, Fertilizantes Tocantins (FTO), in the second half of 2020.

The strong pricing environment for iron ore concentrate resulted in increased volumes sold to Asia Pacific in the second half of the year, offsetting lower sales volumes in Russia.

Leverage

Net covenant debt increased by 2% year on year, due predominantly to financing of the full FTO acquisition, to reach US$4.3 billion. Still, the net leverage ratio improved to 2.53x as of December 31, 2020 compared to 2.82x the previous year.

In the fourth quarter EuroChem sourced a new five-year syndicated loan facility for $460 million with a possible extension feature for up to $1 billion with a pool of international financial institutions. The facility will go toward refinancing existing debt.

In October 2020, Fitch Ratings affirmed Group’s credit rating at BB with a stable outlook.

In November 2020, Russian analytical agency ACRA Ratings assigned MCC EuroChem a rating of AA-(RU) with a stable outlook, acknowledging the company’s strong business profile, geographical diversification, robust corporate governance and solid financial position.

Corporate developments

In July 2020 EuroChem consolidated in full its key distribution arm in Brazil, Fertilizantes Tocantins, ahead of schedule. The outstanding 50% holding interest minus one share amounted to US$240 million.

In September 2020 Vladimir Rashevskiy was appointed Chief Executive Officer of EuroChem Group to secure a smooth transition into a new growth phase.

In September 2020, following the successful launch of EuroChem Northwest, a 1 MMT ammonia plant that enabled the Group to become fully self-sufficient in this feedstock, the company approved the construction of EuroChem Northwest 2, a new 1.1 MMT ammonia and 1.4 MMT urea plant, on an adjacent site in Kingisepp, Russia. The new plant will contribute to the rise of Group’s market share in the nitrogen segment and expand its presence in export markets. The project will be financed by a long-term non-recourse syndicated project finance loan.

In December 2020 EuroChem sold its Murmansk and Tuapse bulk terminals to SUEK, as part of their new strategy of consolidating transportation assets as a separate business. The Group will continue supplying distributors and end customers all around the world through this logistics infrastructure.

Usolskiy Potash Project produced 2.223 MMT of potash in 2020 and reached its Phase One design capacity of 2.3 MMT per annum. A continued ramp-up is envisaged to add at least 1 MMT to output capacity in Phase Two, reaching a potential total of 4 MMT over the next few years.

The work on shaft construction at the VolgaKaliy Potash Project continued in 2020. The application of state-of-the-art 3D seismic data and thin seam analysis programs to map the potash and salt layers considerably advanced our knowledge of the ore body and enabled the production of 37.5 KMT of test product in 2020. In 2021, we are aiming to provide for a more regular ore production level to match the growing shaft capacity.

Market outlook

Solid market fundamentals for urea are set to continue the strong price trend over the first few months of 2021. In a positive farmer economics environment, US and European demand is ramping up and buyers are playing catch-up from a slow demand start in Q4 2020. In tandem, lower production from China while India contemplates yet another import tender maintains a snug supply and demand balance over the next months, in which buyers entertain increasing prices to secure timely deliveries.

On the back of the robust urea market, and further supported by high gas costs, nitrates prices are following suit upwards into the spring season.

Highly favourable farmer economics for phosphate fertilizers will support very strong phosphates demand across North America, China and Europe in 1Q 2021. A recovery in Chinese phosphate fertilizer demand is underpinned by a recovery in farming and will continue to limit export supply and keep the global phosphate market tight. Good water availability in India and barter ratios in Brazil indicating excellent phosphate fertilizer affordability will continue to support phosphate fertilizer demand in 2Q 2021 and beyond.

The reduced pace of potash supply increases in 2021 combined with strong demand fundamentals will result in tighter market conditions versus 2020. We expect that MOP contracts will be signed in China in 1Q 2021 at higher levels, reflecting both the tighter supply and demand conditions and the recent price gains in the United States, Brazil and South-East Asia. Excellent potash affordability to grain, oilseed and oil palm farmers will support continued strong demand growth through 2021.

Iron ore prices are holding steady on continued restocking activities in China. Concerns of supply chain interruptions, as reflected in buoyed steel futures prices, indicate continued healthy iron ore price levels in the time to come.

This EuroChem publication contains forward-looking statements concerning future events. These statements are based on current EuroChem’s information and assumptions concerning known and unknown risks and uncertainties.

About EuroChem Group AG

EuroChem is a leading global producer of nitrogen, phosphate and potash fertilizers. The Group is vertically integrated with activities spanning mining to fertilizer production, logistics, and distribution. EuroChem launched potash production at its Usolskiy site in 2018 and has since ramped up output to Phase One operational capacity of 2.3 MMT per annum. The Group continues to develop a second greenfield site at VolgaKaliy in Russia. Headquartered in Zug, Switzerland, the Group operates production facilities in Europe, Asia and the CIS, employing more than 27,000 people.

For more information, please visit www.eurochemgroup.com. Any media or analyst enquiries should be directed to the appropriate EuroChem Group contact, as listed below:

INVESTORS

Oxana Kovalenko

Head of Investor Relations

EuroChem Group AG

oxana.kovalenko@eurochemgroup.com

MEDIA

David Nowak

Deputy Head of Communications

EuroChem Group AG

david.nowak@eurochemgroup.com

RUSSIAN MEDIA

Vladimir Torin

Head of Public Relations

MCC EuroChem

vladimir.torin@eurochem.ru